October 14, 2025

OpenFX Reaches $20 Billion: Why Settlement Speed Is the New Infrastructure Moat

Prabhakar Reddy,

Founder & CEO

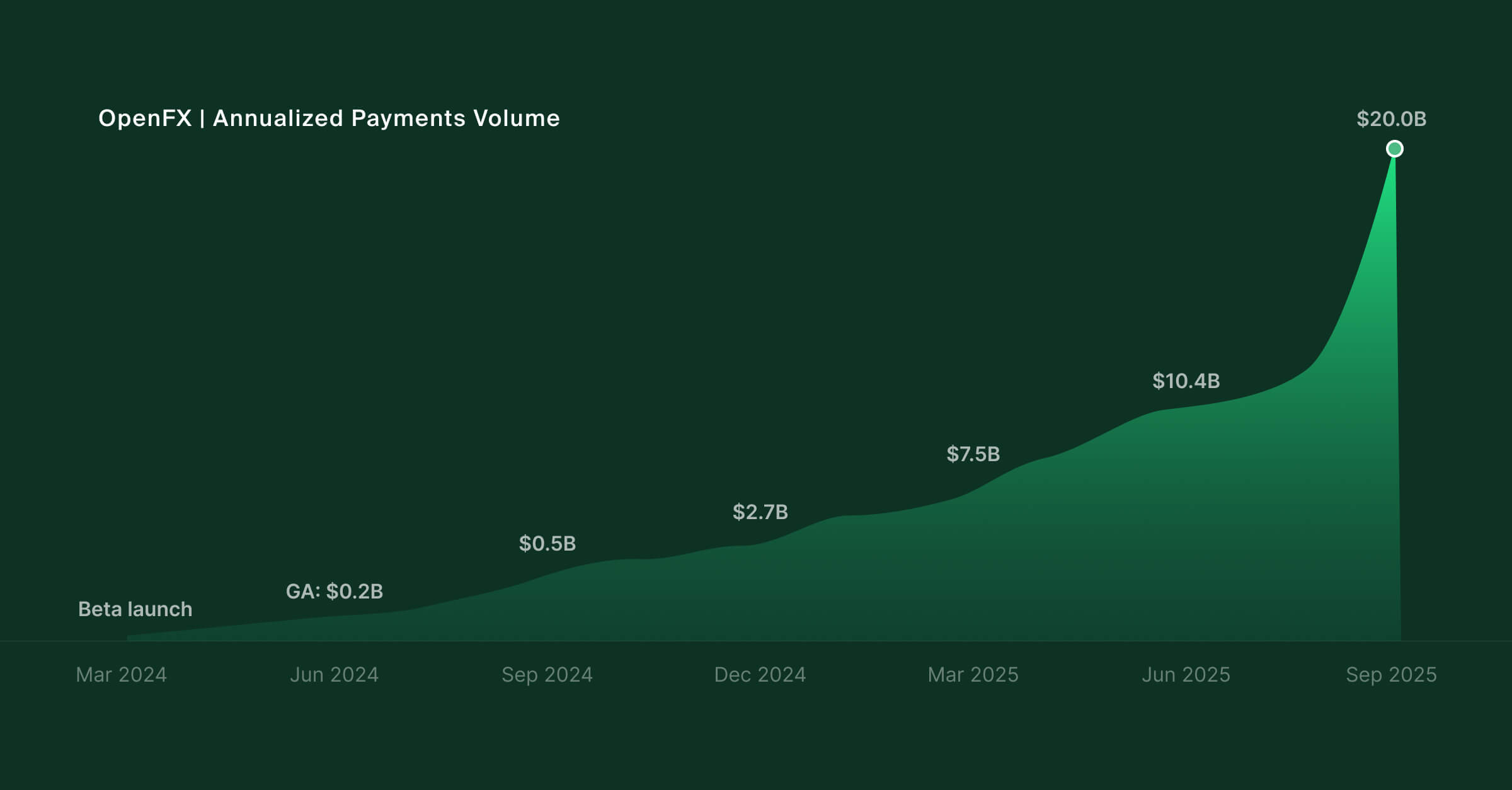

$0 to $20B in 18 months.

That's the headline, but it’s what happened between those two numbers that I want to discuss today.

Five months ago, we came out of stealth at $8B in annualized payment volume. Last month, we crossed $20B. Somewhere along that journey, the customer conversation fundamentally changed.

At $8B, enterprises asked, "How much cheaper are you than our current provider?"

At $20B, they ask, "How fast can you settle, and how fast can we migrate everything to OpenFX?"

That shift—from cost comparison to settlement speed—is the inflection point.

From Cost Savings to Structural Speed

At $8B, we competed on price. At $20B, we compete on speed.

OpenFX delivers sub-60-minute settlements on 90% of transactions. Legacy FX providers take 2-7 days.

The differences between settling in 60 minutes vs 7 days are monumental, allowing businesses to eliminate entire categories of operational overhead.

When you wait 2-7 days for FX settlement, you need:

Treasury teams managing float risk across multiple currencies and time zones

FP&A resources forecasting cash availability 48-72 hours in advance

Working capital locked up in transit, creating opportunity cost

Hedging strategies to protect against currency moves during settlement windows

Reconciliation processes that span multiple days and systems

When settlement happens in under 60 minutes, all of that becomes unnecessary.

One recent customer, a fintech moving multi-billion dollar volumes, told us, "We thought we'd save on fees with OpenFX. Instead, we eliminated an entire treasury headcount dedicated to managing 2-day float volatility across 7 currency pairs. The ROI wasn't in the pricing—it was in the speed eliminating work that shouldn't exist."

When customers start calculating value in eliminated headcount rather than basis points saved, you've crossed into a different category of infrastructure.

Why Legacy Providers Can't Compete on Speed

Legacy FX providers can't replicate real-time settlement. Their infrastructure wasn't built for it.

Correspondent banking relies on batch processing, multi-bank intermediation, and sequential workflows across time zones. To substantially decrease settlement speeds on these legacy rails, you would have to rebuild them from the ground up – banking relationships, compliance workflows, treasury operations, risk systems.

I built OpenFX for real-time settlement. Every component was designed with speed as the primary constraint.

That's why we can process $100M+ volume days multiple times per week with the same settlement speed as $100K or $1M transactions. Legacy providers slow down under load, their architecture requires human intervention. Ours scales because speed is structural, not operational.

What Actually Changed Between $8B and $20B

1. The Customer Profile Shifted to Speed-Dependent Use Cases

Our early adopters were crypto-native startups where speed was culturally expected. Today's customers are established Fintech companies—with billions in annual volume, switching from legacy providers they've used for years.

They're not switching for marginal cost savings. They're switching because their business models increasingly require real-time settlement.

Use cases that only work with sub-60-minute settlement:

Real-time FX for marketplaces: Platform takes a transaction in GBP, pays out in MXN within the hour

Dynamic treasury optimization: Finance teams rebalancing currency positions multiple times per day based on real-time rates

Embedded FX in SaaS products: Companies offering instant cross-border payments as a product feature, not a 2-day delay

These use cases just don’t work in a world where you have to wait a week for settlements to clear.

2. We've Achieved Speed at Scale Through Full Automation

We've achieved near-full automation of currency trading and banking operations across all the markets we’re active in. This matters because speed without scale is a demo. Speed at scale is infrastructure.

We process 90% of transactions in under 60 minutes regardless of volume—whether it's a $100K or $100M transaction. Our largest legacy competitor requires 700+ treasury operations staff for what we handle with 4 engineers in our settlements unit.

We can scale 10x in volume without scaling 10x in headcount, while maintaining the same settlement speed. That's the infrastructure moat.

3. Speed Matters Exponentially More in Volatility

We launched three new corridors in Q3: MXN (Mexican Peso), BRL (Brazilian Real) and Argentinian Peso (ARS). They have become some of our highest-traded currencies within six weeks, making LatAm our fastest growing region.

This is because speed matters exponentially more in high-volatility environments.

Consider a $10M USD → MXN conversion. In a 2-day settlement window, a 3% currency swing equals $300K in exposure. With sub-60-minute settlement, that exposure drops to under $10K.

That’s $290K more operational capital being directed towards hiring and growth, rather than being eaten up in fees.

Why This Matters Beyond OpenFX

A decade from now, CFOs will look back at 2-7 day FX settlement the same way we now look at dial-up internet: technically functional, but absurdly inefficient.

The infrastructure exists. The question isn't IF you'll move to real-time settlement. It's whether you'll lead the transition, or explain to your board why your competitor moved first.

To fintech leaders building the next generation of financial services: Real-time settlement enables business models that don't work with 2-day delays. The question is how fast you're willing to move.

To enterprise teams processing billions in cross-border volume: We're handling $20B for hundreds of institutions who made the switch. They're paying us because sub-60-minute settlement eliminates operational overhead that costs more than our fees.

If you're serious about operational leverage at scale, reach out at hello@openfx.com.

The infrastructure shift is happening. If you are a fintech company moving money across borders, the question is: are you leading it, or watching by the sidelines?

Share article

Read other articles

Stay informed with our latest articles on currency launches, institutional FX trends, and global liquidity.